how likely will capital gains tax change in 2021

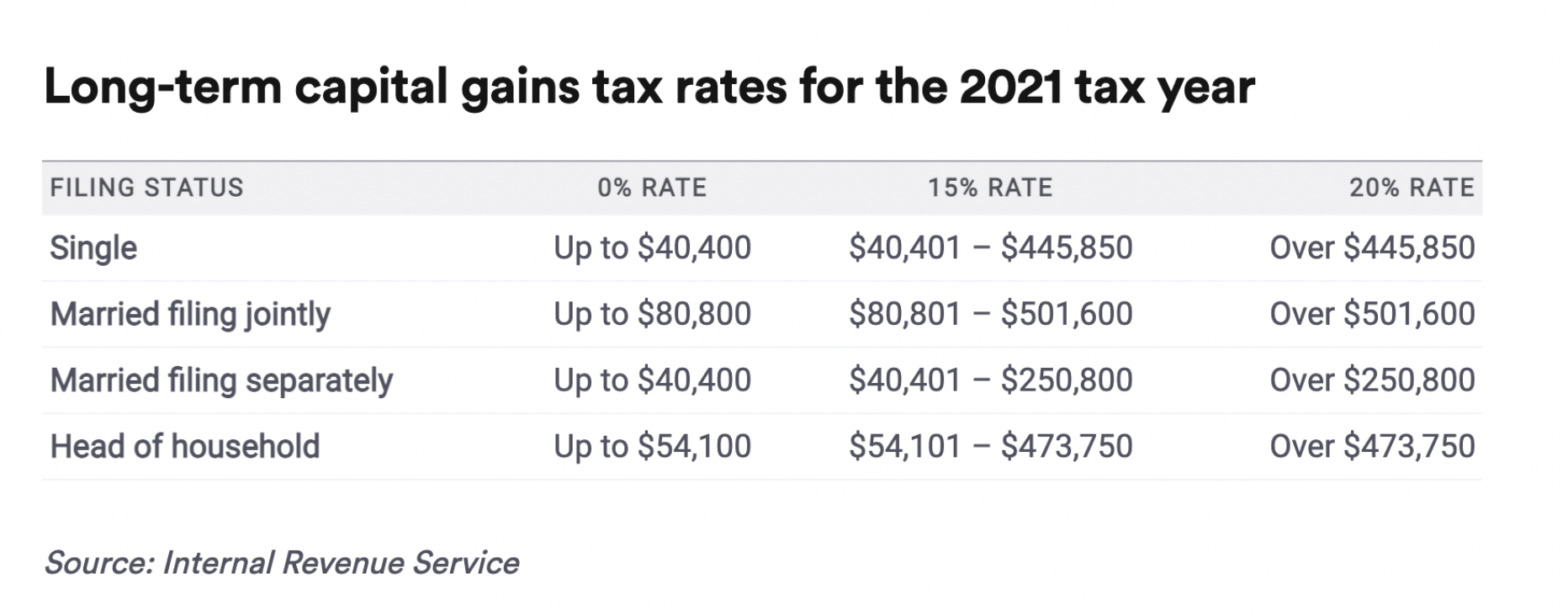

Can I offset new kitchen against capital gains tax. Long-term gains still get taxed at rates of 0 15 or 20 depending on the.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Newer taxes that target wealth unrealized capital gains retirement savings or stock buybacks now seem less likely But some on.

. So investors holding large unrealized capital gains may be more likely to hold if the tax rate increases. Ad Compare Your 2022 Tax Bracket vs. And if retroactive taking action now is not likely to be beneficial.

There is a change on the horizon which can take place as soon as 2022. Estate Capital Gains Tax Changes Likely to Stay in Spending Bill. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

The second part of the report is due in 2021. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some recommended changes to Capital Gains Tax. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25.

Will capital gains change in 2021. Meet with your wealth advisor or estate planner to discuss wealth transfer techniques in 2021. One of the areas the government is looking to increase its tax collection from is capital gains.

An increase in value is not the trigger for the IRS. In 1981 capital gains rates went from 28 percent to 20 percent. This new rate will be effective for sales that occur on or after Sept.

These changes are less likely to. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change.

Tax Outlook Capital gains tax changes. The proposal is bumping this up to 396. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years.

The maximum capital gains are taxed would also increase from 20 to 25. Joe Biden says this tax increase funds. Capital Gains Tax UK changes are coming.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. New Kitchen Units Replacing an Asset in its Entirety. The rates do not stop there.

Currently the capital gains tax rate for wealthy investors sits at 20. News October 21 2021 at 0255 PM Share. Your 2021 Tax Bracket to See Whats Been Adjusted.

Higher capital gains tax rate. Discover Helpful Information and Resources on Taxes From AARP. This proposal would be retroactive to the beginning of 2021.

Historically there hasnt been any correlation between the direction of rate changes and stock prices. Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks at ways. The announcement is likely to come after markets close before one of the mark-up days.

14 and 15 appear to be the most likely proposed effective dates revenue raisers are. 13 2021 and will also apply to Qualified Dividends. As a business seller if you are in either the low or mid earning bracket any proposed changes will not affect you so proceed with the sale of your business.

A key issue is whether the change would apply retroactively to April 2021. Additionally a section 1250 gain the portion of a. The actual day of announcement for a capital gains change will be a closely guarded secret beforehand as members and staff will want to avoid a market-moving leak.

Historically major changes to US tax policy have not been retroactive. Individuals would have a 1 million exclusion for capital gains and an additional exclusion of 500000 for a personal residence. Large capital gains distributions last year set off big tax liabilities for investors at Vanguard and to a lesser extent at some other fund companies said Megan Pacholok a Morningstar analyst.

Congress could approve some sort of change to capital gains taxes sometime this year. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. These changes may be significant and have large ramifications for your investments.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

How Much Is Capital Gains Tax Times Money Mentor

Capital Gains Tax Advice News Features Tips Kiplinger

Selling Stock How Capital Gains Are Taxed The Motley Fool

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

How To Avoid Capital Gains Tax On Rental Property In 2022

How Do Taxes Affect Income Inequality Tax Policy Center

Section 54 54f Income Tax Act Tax Exemption On Capital Gains

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Gains Tax Advice News Features Tips Kiplinger

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Definition 2021 Tax Rates And Examples

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)