housing allowance for pastors form

Clergy Financial Resources also offers Pro Advisor support for your housing and other tax questions. The housing allowance is for pastorsministers only.

From board of pensions as noted on IRS Form 1099R _____ 2-b Total officially designated housing allowance.

. The housing allowance for pastors is not and can never be a retroactive benefit. The pastor should keep a copy of this letter along with a copy of their certificate. Read on for more detail on the housing allowance for pastors and how to record it for tax purposes.

Fill each fillable field. Housing Allowance for Pastor and W2. It is time again to make sure you update your housing allowance resolution.

Here are four important things that you need to know concerning the housing allowance. You should not include the housing allowance portion of the gross payroll amount for calculating the appropriate local tax for your pastoral employees. If you have questions give us a call at 678 825-1198 to schedule an appointment with a Financial Planning Advisor.

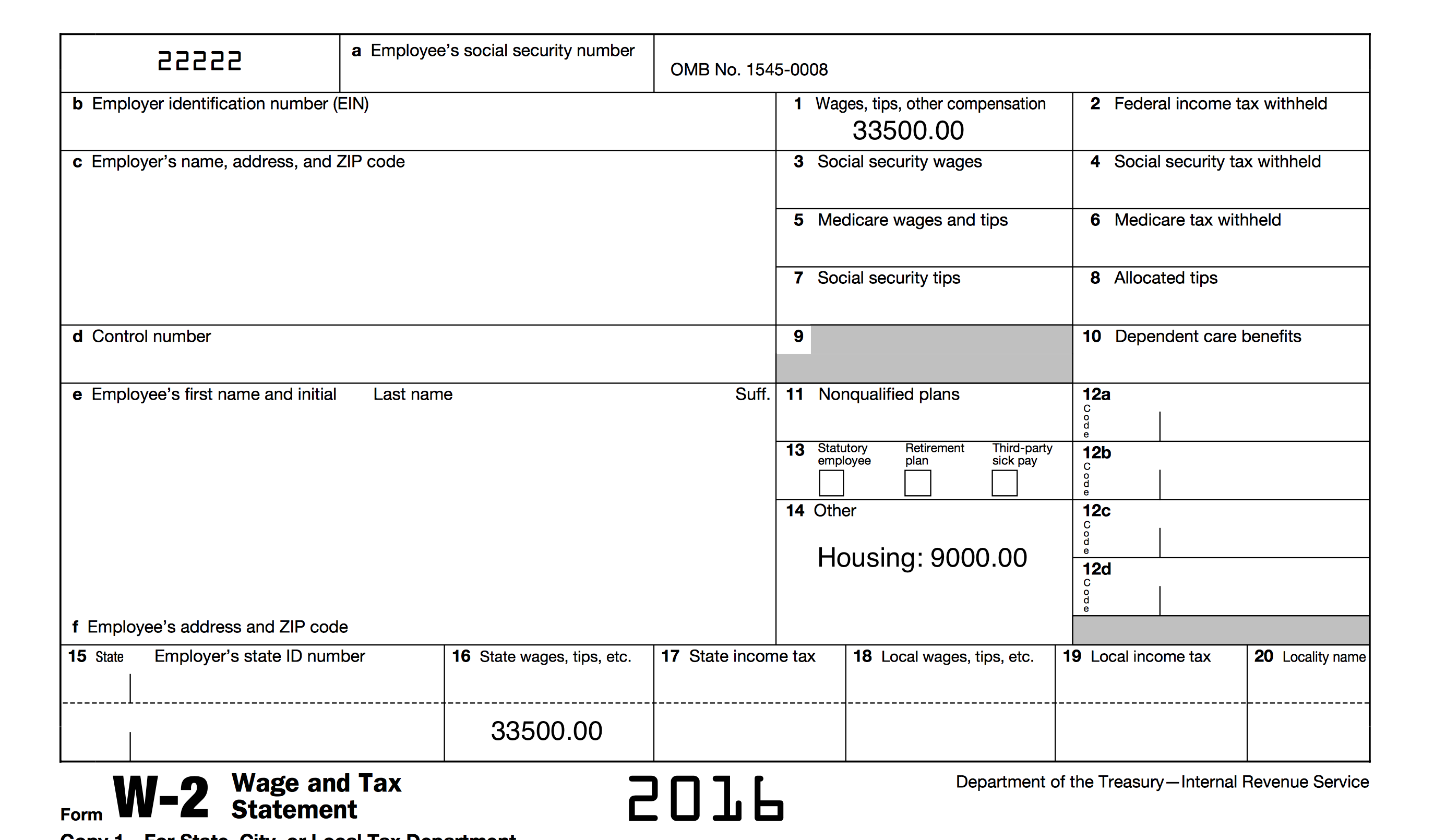

Unless a church includes it in an informational section on Form W-2 the IRS and the Social Security Administration SSA are only made aware of the housing allowance when a minister files. ChurchPay Pros by AccuPay will provide the amount of a pastors compensation designated as housing allowance in Box 14 of the pastors W-2 to assist tax preparers. The housing allowance for all pastors is also tax exempt for local taxes within the Commonwealth of Pennsylvania.

The church is not required to report the housing allowance to the IRS. The amount reported in Box 1 of the 1099-NEC will be subject to income tax and self-employment tax. Housing Allowance for Pastor and W2.

Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020. It is reported by the pastor on Schedule SE of Form 1040 line 2 together with salary. This is an excerpt from my book The Pastors Wallet Complete Guide to the Clergy Housing Allowance.

In that case at most 5000 of the 10000 housing allowance can be excluded. Housing allowance amounts are not taxable on your income tax but are subject to taxation under self-employment laws. This may take different forms such as by resolution budget line item corporate minutes employment contract etc.

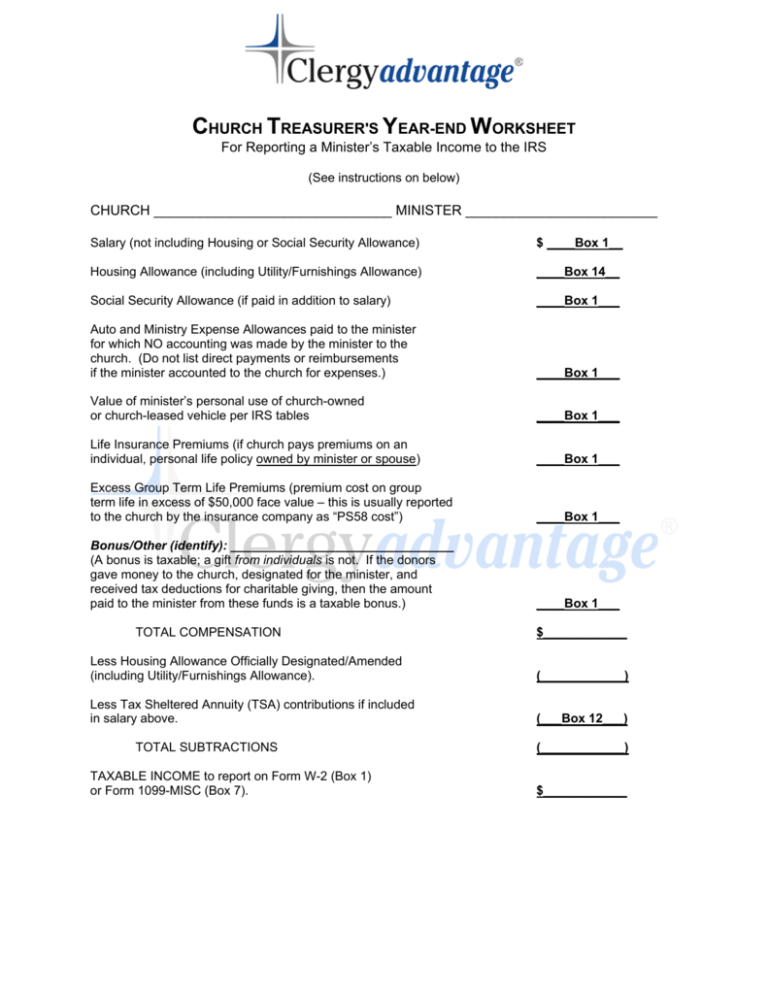

The housing allowance is for pastorsministers only. A Clergy W-2 from a church should show Salary in box 1 and the housing allowance in box 14. Not every staff member at the church can take this allowance.

Box 1 is 37500 Box 14 is 2500. Remember you will need to have the form completed by your pastoral employee. Only expenses incurred after the allowance is officially designated can qualify for tax exemption.

Include the date to the sample with the Date feature. Its suggested that you validate this number by checking with a local realtor. Select the orange Get Form button to start filling out.

Be sure the information you fill in Pastors Housing Allowances is updated and accurate. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. Section 107 of the Internal Revenue Code clearly allows only for ministers of the gospel to exclude some or all of their ministerial income as a housing.

Is an amount paid to a pastor in addition to the salary to cover housing expenses. October 8 2021. From the pastors gross income in that calendar year.

The amount paid to the minister as a HA is not reported on the form W-2. Ad Clergy Housing Allowance Worksheet More Fillable Forms Register and. Taxes with housing allowance Salary of 50000 Housing Allowance of 28000 Reduction of Taxable Income 50000 - 28000 22000 Taxed on 22000 12 2640 Owed income tax of 2640.

Enter the 1099-NECs exactly as you received them - the IRS got a copy of the form that you received and will be expecting you to report the same figures on your return. Most ministers and Pastors are considered employees of the church so you would report their compensation on a W-2with the salary reported in Box 1 and NOTHING in boxes 345 and 6. Housing ExclusionHousing Allowance Designation Form.

Most ministers and Pastors are considered employees of the church so you would report their compensation on a W-2with the salary reported in Box 1 and NOTHING in boxes 345 and 6. The total housing allowance payments can be reported in Box 14 which is simply an informational box for the employee. How is the housing allowance reported for social security purposes.

Resolved that the designation of Amount 00000 as a housing allowance shall apply to calendar year 20__ and all. The pastor will need to designate a housing allowance in order for any or all of it to be excluded from the taxable income on the W-2. The housing allowance exclusion only applies for federal income tax purposes.

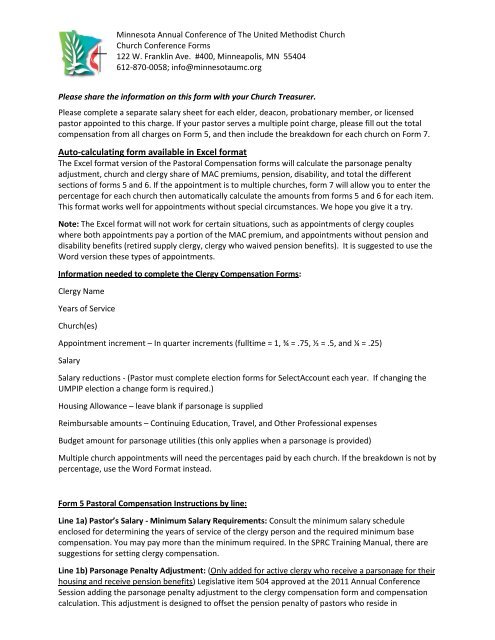

Pastoral Housing Allowance for 2021. The pastor may request a dollar amount or a percentage amount be designated as a Housing Allowance HA. Church boards can use the language below to create a resolution for a pastor who owns or rents a home.

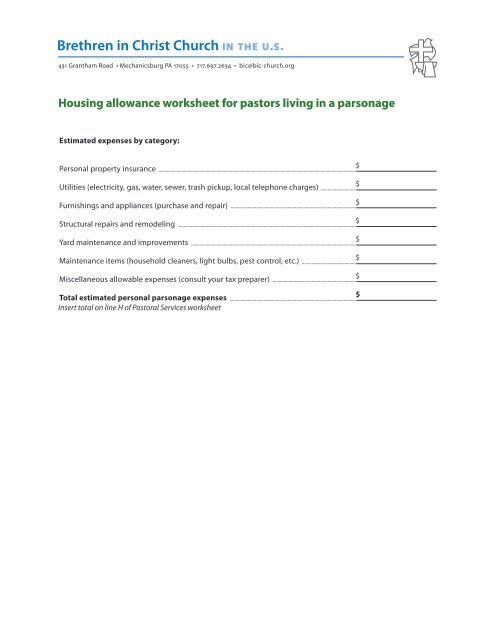

Fair rental value of house furnishings utilities. The eligible housing allowance amount is exempt from federal income taxes but not from self-employment taxes Social Security and medicare unless a minister has filed a Form 4361 and been approved to opt out of social security. Sample Housing Allowance for Pastors.

As mentioned in Business Dictionary this is the definition of the housing allowance. And it is further. Click on the Sign icon and make an electronic.

Ready-to-use resolution language for church board to set a clergy housing allowance in 2022. Ordained clergy are not required to pay federal or state except in Pennsylvania income taxes on the amount designated in advance by their employer as a clergy housing allowance to the extent. Ad Clergy Housing Allowance Worksheet More Fillable Forms Register and Subscribe Now.

Allowances for the members of the military and other job. And mirror the forms in the back of the PCA Call Package Guidelines just follow the links below. Housing allowance - pastor getting a 1099 MISC.

In this illustration there is a 3360 tax savingswith the Housing Allowance. Pro Advisor I Tax Support. Can the housing allowance resolution be adopted or amended mid-year.

The same goes for a housing allowance paid to ministers that own or rent their homes. 0 2 METHOD 3. All other wages paid are reported on the W-2.

Resolved that the total compensation paid to Pastor FirstLast Name for calendar year 20__ shall be Pastors Compenstation 00000 of which Amount 00000 is hereby designated as a housing allowance. This support service is available at a flat rate of 7500 for each 30-minutes session. Housing Allowance Calculation Form for Ministers Who Own or Rent Their Own Home This form is for helping ministers determine the appropriate amount to claim as housing allowance.

If your salary is 37500 and the housing allowance is 2500 for a total compensation of 40000. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount. Switch on the Wizard mode in the top toolbar to acquire extra suggestions.

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

Forms 5 6 7 8a And 8b Clergy Compensation In Pdf Format

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Housing Allowance Clergy Allowance

Church Treasurer S Year End Worksheet

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet The Pastor S Wallet

Pastoral Housing Allowance Fill Online Printable Fillable Blank Pdffiller

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Housing Allowance Request Form Brokepastor

Fillable Online Agncn Housing Allowance Request Ncn Assemblies Of God Agncn Fax Email Print Pdffiller

The Minister S Housing Allowance

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller